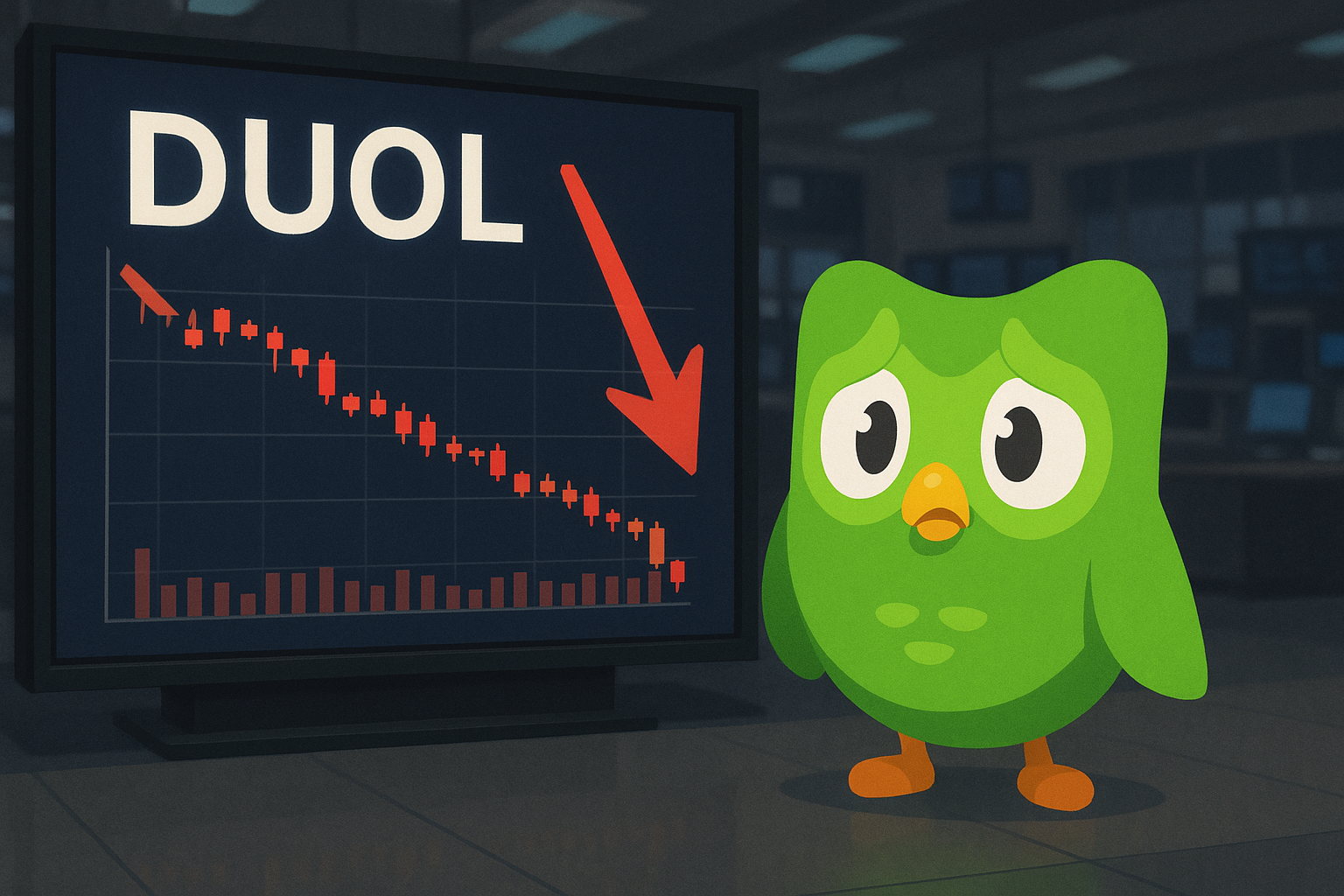

Duolingo shares cratered yesterday — plunging a staggering 27% after the language-learning app's guidance apparently failed to conjugate properly with analyst expectations. The selloff hit despite what most reasonable observers would call solid quarterly results, painting a familiar picture of our market's increasingly bizarre relationship with growth stocks.

I've covered tech stocks for years now, and this reaction feels like déjà vu all over again. Beat earnings, miss guidance by a hair's breadth, and suddenly investors are heading for the exits like someone just yelled "fire!" in a crowded theater. It's almost comical... except for the shareholders watching their portfolios bleed out in real time.

So what actually happened here? Let's dissect this.

Duolingo posted Q1 revenue of $167.6 million — a robust 45% jump year-over-year that sailed past estimates. Daily active users? Up a whopping 65% to 28.8 million. Bookings grew 49% to $192.8 million, and their adjusted EBITDA more than tripled to $34.6 million.

By any sane measure, that's a knockout quarter.

But then came the guidance. The company projected Q2 revenue between $168-$171 million, just shy of the $173.7 million analysts were hoping for. And that, friends, is apparently cause for a quarter of the company's market value to evaporate. Makes perfect sense, right?

(It doesn't.)

The real story here — one I've seen play out countless times covering tech companies — is the classic tension between short-term financial optimization and long-term strategic growth. Duolingo is clearly betting on the latter.

"We're focused on sustainable user growth," CEO Luis von Ahn explained during the earnings call. Having listened to dozens of these calls, I can translate the corporate-speak: We're spending money now to acquire users who'll pay us later.

Look, this is straight out of the growth company playbook. But Wall Street often has the attention span of my nephew after three Pixy Stix.

There's something particularly ironic about this situation. Duolingo's entire product is built around the concept that meaningful progress takes time. Anyone who's tried to learn Spanish knows you can't cram your way to fluency overnight. Yet investors seem to be punishing the company for applying this same philosophy to its business.

The fundamentals here remain compelling. The global language learning market is expected to hit $47 billion by 2025. Duolingo has cracked the code on engagement with its gamified approach. And their subscription model? That's the recurring revenue dream most tech companies would kill for.

What's more, their paid subscribers increased 57% year-over-year to 6.2 million. That's the whole ballgame right there — they're successfully converting free users to paid customers, which is precisely what their strategy is designed to do.

I spoke with several retail investors yesterday who were utterly baffled by the market's reaction. "It feels like Wall Street is speaking a different language than the rest of us," one told me, unintentionally nailing the irony.

The punishment here seems wildly disproportionate to the crime. A slight miss on forward guidance shouldn't erase a quarter of a company's value overnight. That's not rational price discovery; it's a temper tantrum dressed up as financial analysis.

Then again... Duolingo shares had skyrocketed over 100% in the past year before this drop. Perhaps some recalibration was inevitable? Markets, much like languages, have grammar rules that sometimes defy logical explanation.

For what it's worth, I think Duolingo will recover from this. They've got a viable path forward. The question is whether investors have the patience to stick with the full language course or if they'll drop out after the first challenging module.

As they might say on the app itself: you've lost a heart, but you haven't failed the lesson.