The latest jobs report dropped last week, and while everyone's busy analyzing tech layoffs against the backdrop of a surprisingly resilient labor market, I've been watching something far more interesting unfold in America's boardrooms.

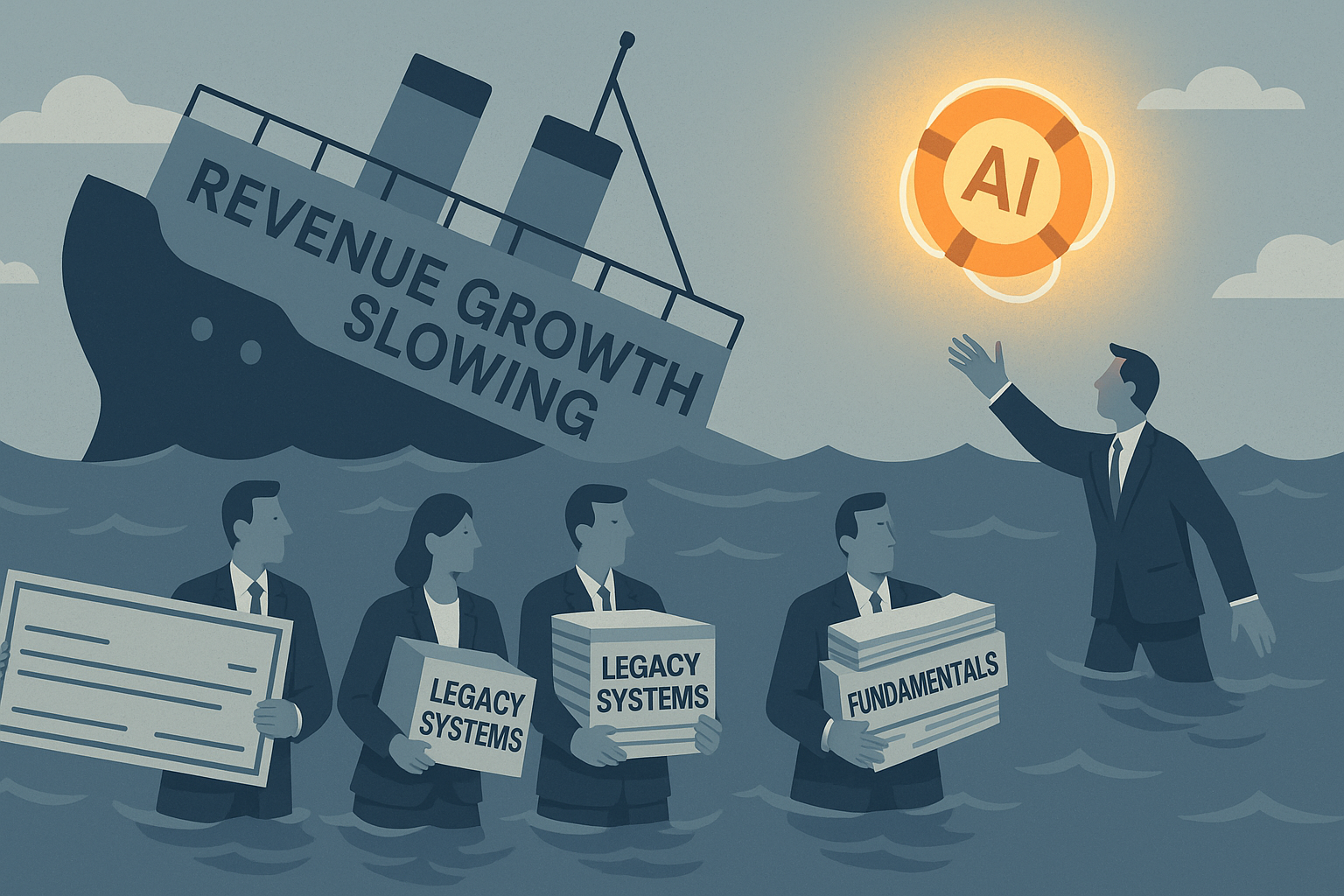

Corporate executives are signing massive checks for AI initiatives—sometimes with the desperation of a drowning person reaching for anything that floats.

Here's the situation: AI investment is projected to hit a staggering $200 billion this year, jumping nearly 25% from last year's already substantial figures. At the same time, S&P 500 companies are watching their revenue growth slow to a crawl. The cognitive dissonance is striking—these same companies announce layoffs and AI investments in the same breath, like someone canceling their health insurance to afford a luxury gym membership.

I've been tracking this trend since early 2022, and what we're seeing follows what I call the "technological panic purchase" pattern. When potentially transformative technology emerges, executives face an impossible choice: invest heavily despite uncertain returns or risk becoming the next Blockbuster Video. The problem? Everyone makes this decision simultaneously, creating a corporate version of the prisoner's dilemma.

Take that major retailer (you know the one I'm talking about) that recently announced a $500 million AI initiative while simultaneously shuttering 15% of their physical locations. Their CEO—with a straight face—told investors, "While we face short-term challenges, our AI investments position us for long-term success."

Translation: "Our core business is struggling, but look at this shiny new toy!"

Now, to be fair, some AI investments make perfect sense. JPMorgan using machine learning for fraud detection? Smart. UPS optimizing delivery routes with AI? Brilliant. But for every thoughtful application, I've witnessed ten executives demanding ChatGPT clones without any clear business case beyond "everyone else is doing it."

The pattern follows what analysts call the "technological FOMO curve":

Phase 1: Early adopters implement technology for clear use cases Phase 2: Everyone else panics and implements the same technology for unclear reasons Phase 3: Most implementations fail to deliver expected returns Phase 4: Disillusionment sets in, budgets get cut Phase 5: The technology quietly becomes useful in specific applications

We're firmly in Phase 2, folks. And the crash is coming.

Look, I'm not saying AI isn't transformative—it absolutely is. But remember the dot-com bubble? The internet eventually changed everything, but not before countless companies went bust chasing digital dreams without viable business models.

During a conference in Chicago last month, I spoke with a retail CEO (off the record, naturally) who admitted his board was pressuring him to "do something about AI" despite more fundamental problems. "They don't care that our inventory management system is from 2005," he confided. "They want me talking about machine learning on the earnings call."

This... seems problematic.

The winners in this environment won't necessarily be those making splashy AI announcements. They'll be companies maintaining focus on fundamental business challenges while selectively applying AI where it genuinely solves problems.

For many businesses right now, AI isn't actually a growth strategy—it's survival mode dressed as innovation. They're desperately hoping productivity gains materialize before their cash reserves dwindle. It's a race against their own burn rate.

Should you worry about the economy? Probably not immediately. All this AI spending is creating jobs and driving growth in the short term. But watch carefully for the inevitable disillusionment phase. When it hits (and it will), companies that mortgaged their future on magical AI solutions rather than addressing underlying business problems will face a reckoning.

After all, even the smartest AI can't save a fundamentally broken business model.

Though I'm sure someone in Silicon Valley is raising venture capital right now to try.