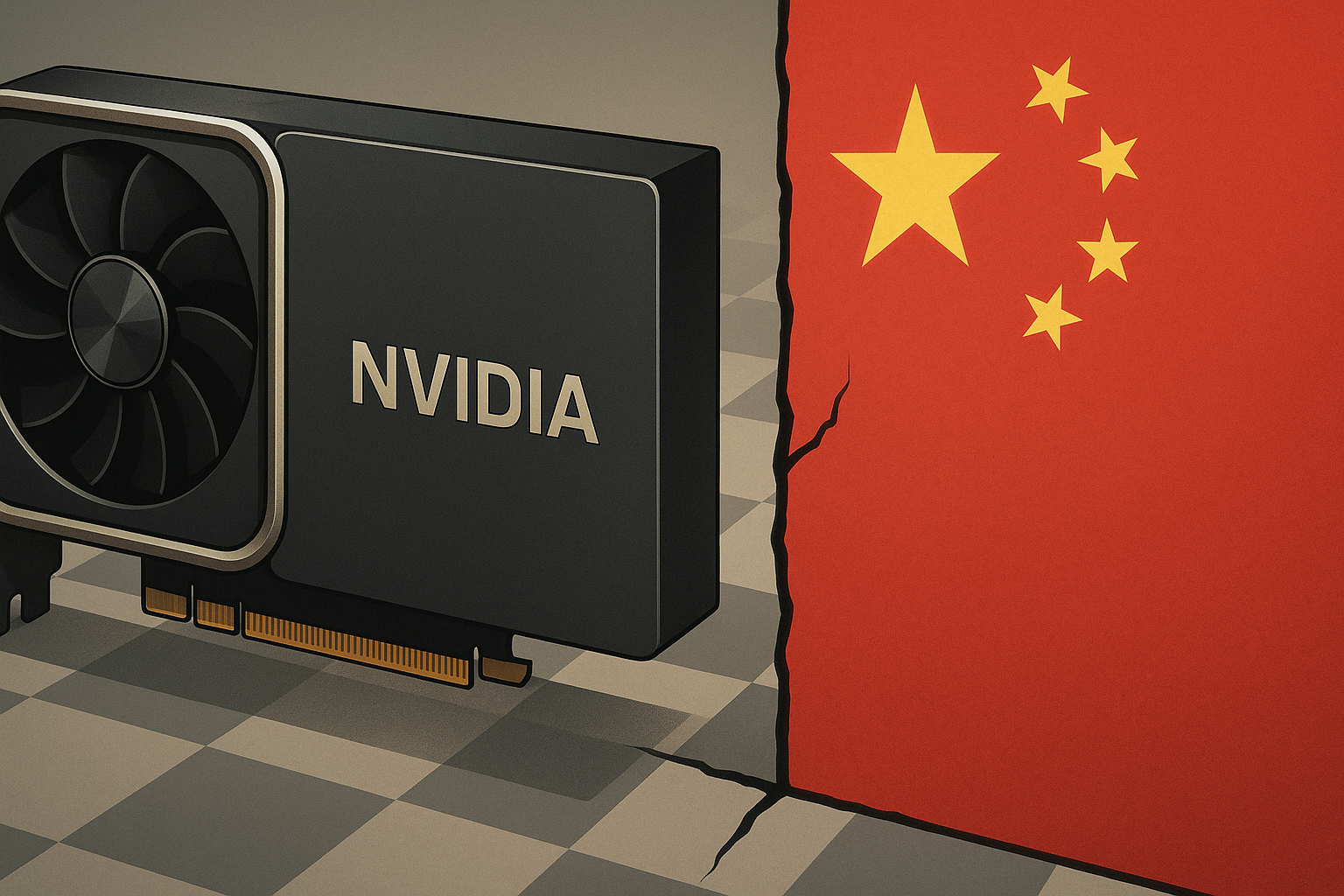

So, China has finally dropped the hammer. After months of tension and speculation, Beijing has told its tech giants to stop ordering Nvidia's export-control-compliant chips, including the RTX Pro 6000D—hardware specifically designed to thread the needle of U.S. restrictions.

I've been watching this slow-motion technological divorce for years, and let me tell you, it's like seeing a relationship end where both parties insist they're the one doing the breaking up.

The timing here is... well, let's call it pointed. Just as Nvidia CEO Jensen Huang (you know, the leather jacket guy) was preparing to meet with President Trump in London, Chinese officials were busy dismantling his company's last meaningful revenue stream in the world's largest consumer market. Talk about awkward timing.

"We can only be in service of a market if the country wants us to be," Huang remarked with the kind of understatement that masks what must be considerable corporate anxiety.

What's happening here isn't just business—it's geopolitics with a balance sheet. For the better part of two decades, we've operated under what I'd describe as a system of "technological codependence." The West designs advanced chips, China manufactures and consumes them, everyone makes money. National security experts periodically write concerned reports, and life goes on.

But that arrangement started crumbling when the Biden administration implemented export controls targeting China's access to advanced AI chips. Nvidia, eager to preserve its massive Chinese revenue, created special China-compliant versions that technically met U.S. restrictions.

Now Beijing has essentially said: "Thanks, but we're good."

(Having covered Chinese tech policy since 2018, I've noticed this pattern before—what looks like economic self-harm often signals confidence rather than desperation.)

This ban doesn't come from weakness. It comes from a position of perceived strength. After meetings with domestic chipmakers like Huawei and Cambricon, Chinese officials apparently concluded their homegrown chips have caught up enough to risk cutting the Nvidia cord.

Is that true? Maybe not entirely. But perception drives policy just as much as reality does.

Look, we've seen this playbook before in other sectors. Countries typically implement capital controls not when they're weakest, but when they believe they're strong enough to weather the isolation. China isn't rejecting Nvidia because it can't get the chips—it's rejecting them because it thinks it doesn't need them anymore.

For Chinese tech companies caught between American export controls and their own government's technological nationalism... well, the message couldn't be clearer: domestic supply chains or bust.

An executive at one major Chinese tech firm told me last month (before this announcement) that many had been hoping for renewed Nvidia access if U.S.-China relations improved under a potential second Trump administration. That hope now seems as outdated as MySpace.

The financial implications extend far beyond Nvidia's quarterly earnings reports (though shareholders certainly won't be thrilled). This represents another significant step in unwinding the globalized technology supply chains that defined the post-Cold War era.

Markets have been surprisingly slow to price in the full costs of this technological decoupling—perhaps because it's happening in increments rather than all at once. Death by a thousand cuts is harder to quantify than a single execution.

What's fascinating—and slightly maddening from a logical standpoint—is how China and the U.S. are both racing toward the same goal: semiconductor self-sufficiency. It's like watching divorced parents accidentally buy identical birthday presents without consulting each other. Different motivations, same outcome.

For investors trying to navigate this mess... good luck! But seriously, the winners might not be who you expect. Beyond the obvious Chinese chip designers, companies building the equipment needed to manufacture chips domestically could see surprising benefits. The semiconductor equipment market might be the real battlefield—and one where Western companies still maintain significant advantages.

The way China is implementing this shift is particularly noteworthy. Rather than blunt instruments like formal bans or tariffs, they're using regulatory pressure and behind-closed-doors directives. It maintains plausible deniability while achieving the same effect. Classic Beijing.

Meanwhile, did you notice how China recently accused Nvidia of violating antitrust law in its acquisition of Mellanox? When countries suddenly discover competition concerns with foreign companies... well, it's rarely about a sudden passion for market efficiency.

Whatever happens next, markets will eventually adapt to this new reality. They always do. But the transition period promises to be volatile, unpredictable, and occasionally absurd—which, when you think about it, is a pretty good description of the semiconductor industry as a whole.