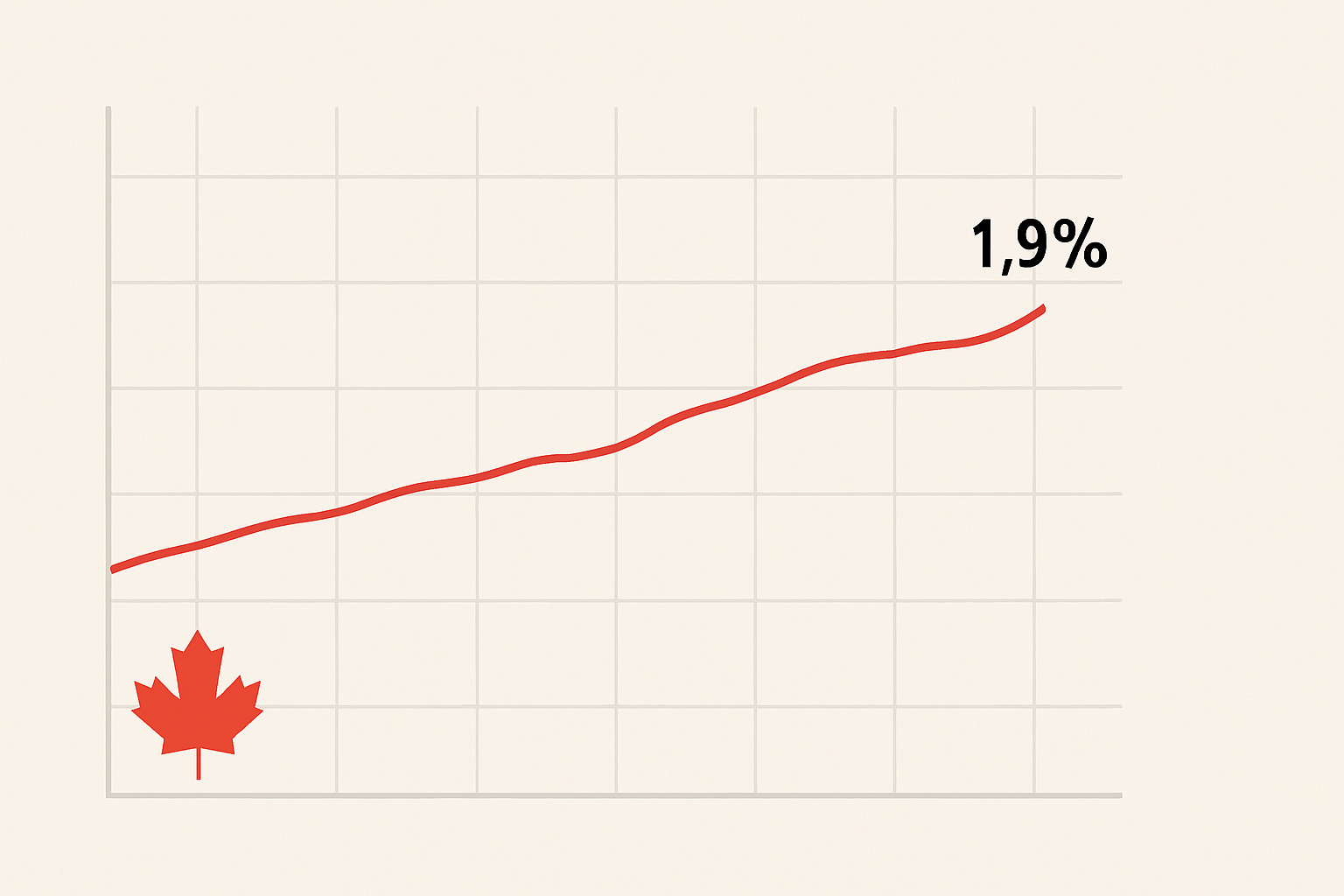

Canada's inflation rate tiptoed up to 1.9% in August, and honestly? It's about as thrilling as watching maple syrup drip down the side of a jar. Slow, predictable, and quintessentially Canadian.

The modest bump—just shy of the Bank of Canada's sacred 2% target—comes after months of economic indicators that have been, well, indicative of not much at all. It's the kind of news that makes economists shrug and financial reporters struggle to find an angle spicier than "things continue to be basically fine."

"We're seeing remarkable stability," noted financial analyst Meredith Chen in what might be the most Canadian economic assessment possible. "Nothing to worry about, really."

The contrast with our neighbors to the south is striking. While U.S. Federal Reserve officials have been performing monetary gymnastics that would impress Olympic judges, Canada's central bankers seem to be achieving their targets with all the effort of someone who accidentally wins at bingo.

I've been covering North American economic trends since 2018, and this divergence is what some economists call a "hockey stick moment"—when two historically aligned economies suddenly bend in different directions. The handle represents years of correlation; the blade is when local factors abruptly matter more.

Look, nobody's throwing a parade over 1.9% inflation. It's not an achievement so much as an absence of failure. But in a global economy where central banks often miss their targets by margins that make accountants reach for antacids, Canada's steady performance deserves at least a polite golf clap.

Housing costs—typically the drama queen of Canada's economic indicators—have remained surprisingly tame lately. This after years of real estate insanity that had millennials in Toronto and Vancouver wondering if they should just build houses out of their avocado toast because it might be more affordable.

What does this mean for average Canadians? Not much, and that's the point. It's inflation that doesn't force you to reconsider your grocery list or postpone retirement another decade. It's the economic equivalent of "nothing to see here, folks."

The Bank of Canada will likely view this news with all the excitement of someone reading the nutritional information on a cereal box. Their monetary policy can continue on autopilot, which for central bankers is basically nirvana.

(I spoke with several economists who confirmed this assessment, though none wanted to be quoted saying something as boring as "everything's fine.")

Will it last? Who knows. Economics has a nasty habit of lulling us into complacency right before smacking us with a surprise. Markets turn faster than politicians during scandal season.

For now, though, Canada's 1.9% inflation is like getting a B+ on your economics homework. Not frame-worthy, but... y'know, fine. And sometimes—particularly when it comes to inflation—"fine" is exactly what you want.

In a world of economic extremes, Canada's middle-of-the-road performance might just be its own kind of exceptional. Even if it makes for headlines that could double as sleep aids.