BYD just made a fascinating strategic pivot. The Chinese EV giant has cut its 2025 sales target by a hefty 16% to 4.6 million vehicles, but—and this is the interesting part—they're simultaneously predicting exports will make up about a fifth of their global sales next year.

We're talking 800,000 to 1 million vehicles leaving China in 2025. That's not just ambitious; it's a fundamental reshaping of their business model.

I've been watching Chinese automakers for years now, and this move strikes me as classic market saturation response. BYD essentially admits they've hit something of a ceiling in their hypercompetitive home market, where price wars have been absolutely brutal. So what do they do? Look elsewhere for growth. Tale as old as time.

The company's been China's EV darling for so long that any admission of slowed growth feels significant. For five straight years, they've been breaking records with the kind of expansion that makes investors swoon. Now they're facing what you might call "merely impressive" rather than "jaw-dropping" growth.

It reminds me of what happened with smartphone makers around 2016. Once local market penetration hits certain thresholds, companies must pivot from depth to breadth strategies. BYD's clearly hitting diminishing returns in China while eyeing greener pastures abroad.

Their export ambition? Remarkable. A 20% export ratio would catapult BYD into the big leagues of global auto exporters practically overnight. (Toyota, by comparison, typically exports about 60% of its Japanese production, but they've been at it for decades, not months.)

Here's where it gets really interesting, though.

BYD's making this push despite Europe slapping provisional duties up to 37.6% on Chinese EVs and the U.S. maintaining a prohibitive 100% tariff. Either they've got cost advantages that can absorb these hits, or—more likely—they're accelerating their manufacturing footprint outside China.

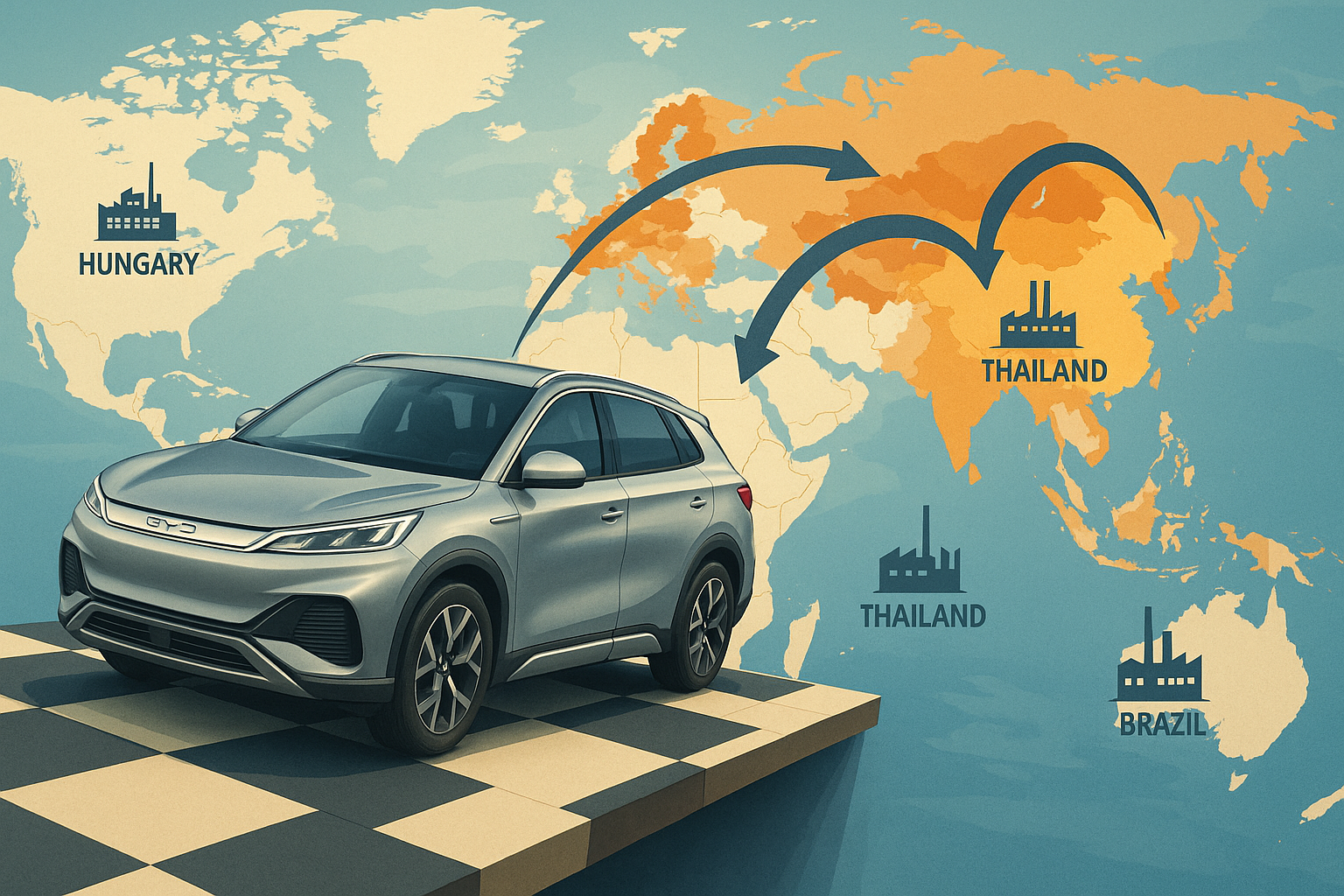

The company's already breaking ground on factories in Thailand, Brazil, and Hungary, essentially creating a tariff-bypassing network. Smart move, if you ask me.

The timing isn't coincidental. Beijing's currently wrestling with domestic industrial overcapacity, especially in the EV sector. BYD's export push aligns perfectly with government priorities to find foreign markets for Chinese goods rather than letting companies cannibalize each other at home.

What should Western automakers make of this? They should be worried. Really worried.

BYD isn't just cranking out cheap electric cars anymore—they're building legitimately competitive vehicles across multiple price segments. Their premium models like the Yangwang U8 and U9 show they've got ambitions well beyond budget offerings.

But hang on—can they actually overcome the significant barriers to entry in established markets? Brand perception matters in cars (just ask Hyundai how long it took them to shake their initial cheap-car image). Service networks take years to build. And let's not forget the growing geopolitical resistance to Chinese industrial might.

Their aggressive dealer partnerships and pricing suggest they're dead serious about clearing these hurdles. Having seen their vehicles up close at several auto shows, I can tell you they're not messing around on quality either.

This BYD situation is just the leading edge of a much larger shift in Chinese industrial strategy. As domestic growth moderates, China's manufacturing champions are being explicitly encouraged to look abroad. It's a new phase of competition.

For investors trying to make sense of this, BYD presents an intriguing case. Is a company growing more moderately but more globally actually more valuable long-term than one fighting tooth-and-nail for domestic market share? History suggests successful international expansion often builds more durable advantages.

One thing's crystal clear—Western automakers can no longer pretend Chinese EV makers aren't coming for their lunch. The game has gone global, and BYD just showed us their next few moves on the board.