The world of cryptocurrency investing has never been simple. But when ProShares launched its Bitcoin Strategy ETF (ticker: BITO) back in October 2021, it seemed like a watershed moment—the first SEC-approved Bitcoin futures ETF had arrived, and investors poured nearly a billion dollars into it within days.

I remember the launch well. The crypto community was practically giddy. Finally! A Bitcoin investment you could buy right alongside your Apple shares without mucking around with digital wallets or sketchy exchanges.

But here's the rub: convenience always comes with fine print.

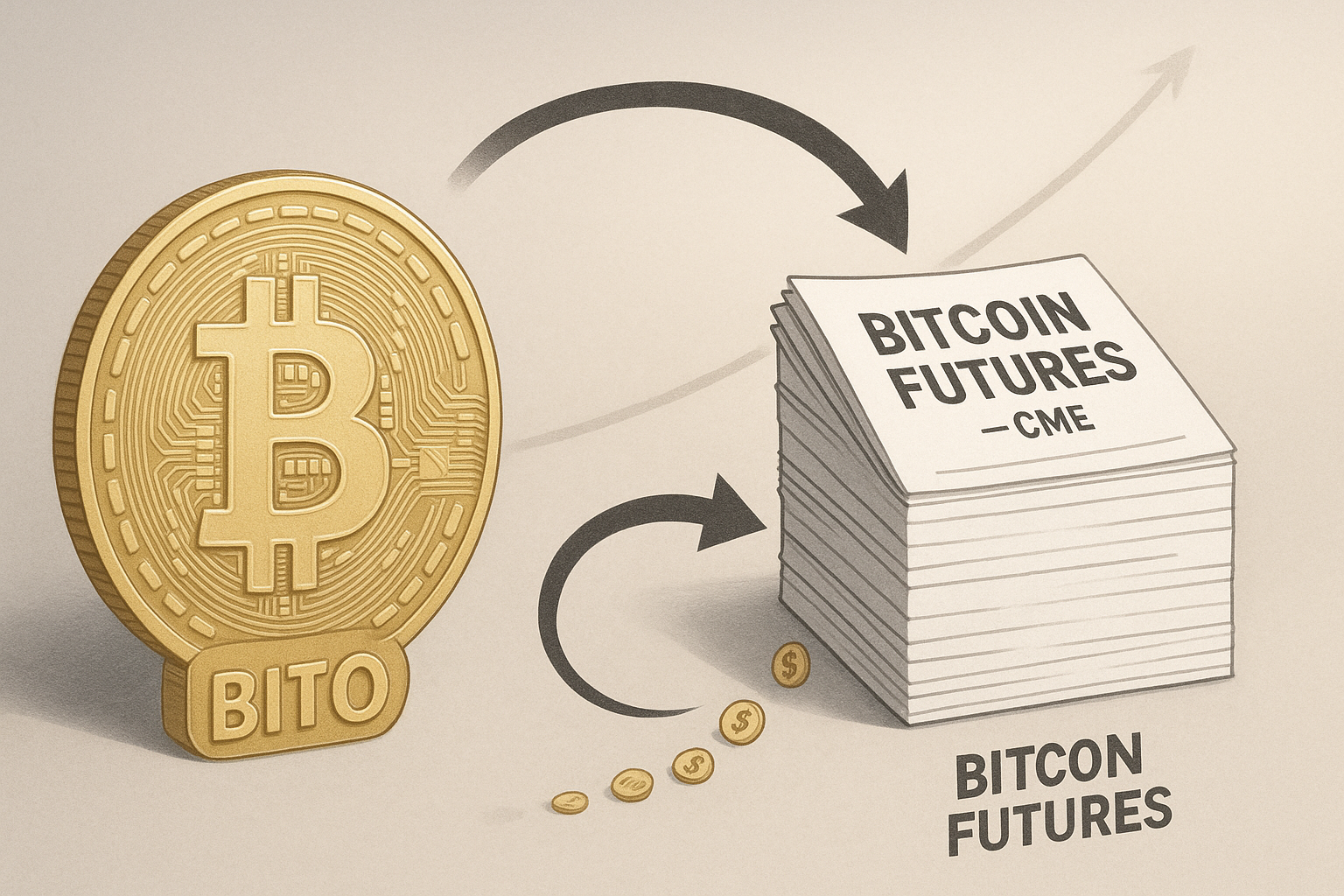

BITO doesn't actually own Bitcoin—not a single satoshi. Instead, it holds Bitcoin futures contracts traded on the Chicago Mercantile Exchange. This distinction isn't just academic; it fundamentally alters how the investment behaves.

The problem? Contango. (No, not the dance.)

When future prices exceed spot prices—creating that upward-sloping curve that derivatives traders lose sleep over—BITO gets caught in a nasty cycle. The fund must regularly "roll" its contracts, selling expiring ones to buy new ones. In a contango market, this means perpetually selling low and buying high. Not exactly Investing 101.

"It's like paying a premium for Bitcoin exposure with a regulatory stamp of approval," explained one portfolio manager I spoke with last week. "Over a week or month? Probably negligible. Over years? The math gets ugly."

And those so-called "dividends" some investors talk about? They're not dividends at all. Bitcoin doesn't generate earnings or pay interest. What BITO distributes are capital gains from its futures trading—essentially returning your own money to you as a taxable event. Surprise!

Look, there's certainly a place for BITO in the investment landscape. For retirement accounts where direct crypto purchases remain challenging, or for investors who break into hives at the thought of managing private keys, BITO fills a legitimate need.

But is it the optimal vehicle for long-term Bitcoin exposure? That's... complicated.

Having tracked crypto investment vehicles since 2018, I've watched the ecosystem evolve dramatically. BITO represents a regulatory compromise more than an ideal product design. The futures-based approach was essentially what the SEC would tolerate, not what investors would prefer.

Some investors (and you might be one) have found creative ways to incorporate BITO into broader strategies—holding a core position in actual Bitcoin while using BITO for tactical moves or in accounts where direct crypto ownership isn't feasible.

The market is nothing if not adaptive.

But here's what keeps nagging at me: the longer your time horizon, the more that contango bite will hurt. It's the investment equivalent of a slow leak in your tire—barely noticeable on a quick trip to the store, but potentially disastrous on a cross-country journey.

So what's the verdict? BITO isn't inherently "bad"—it's just a product whose limitations should inform how you use it. Short-term tactical position? Sure. Your only option for Bitcoin exposure in a 401(k)? Understandable. Your primary vehicle for long-term Bitcoin investment? That's where the math gets dicey.

In the end, BITO perfectly exemplifies the current state of crypto investing: progress comes with asterisks, and simplicity often masks complexity.

And in markets, as in life, it pays to read the fine print.