The transformation of Wulf Energy from Bitcoin miner to data center operator has sent its stock soaring 77% in just a month. Now, after that breathless run-up, the shares have settled into what market watchers call a "consolidation phase" around $8.50-9.00.

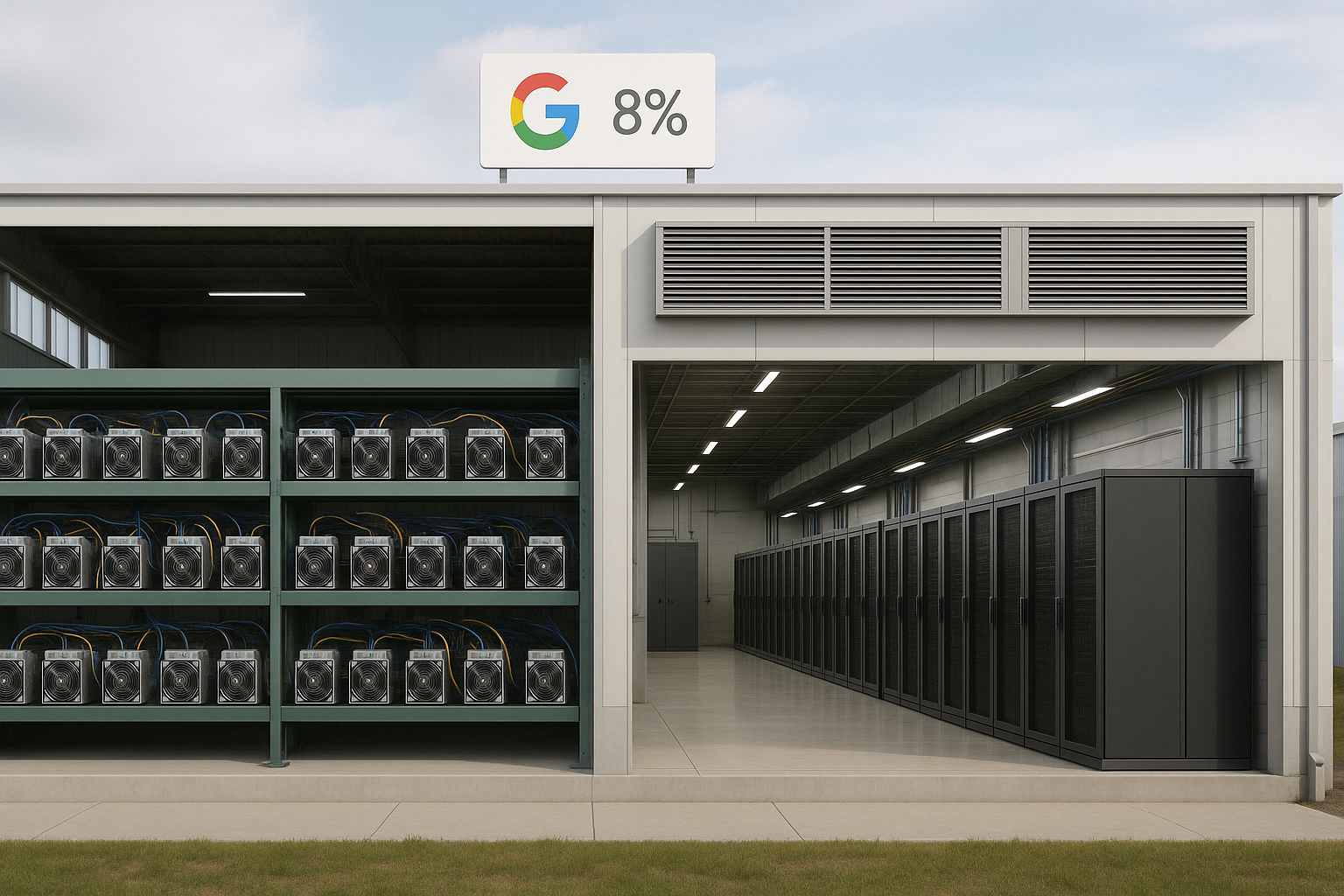

But here's what really caught my attention: Google owns an 8% stake in this company.

Let me be clear—Google has its fingers in so many investment pies that their presence alone doesn't necessarily signal a home run. The tech giant makes strategic investments like most of us make coffee in the morning. But in this case, with Wulf repositioning itself squarely in the data center space that powers Google's AI ambitions... well, it's at least worth raising an eyebrow.

Wulf recently padded its war chest with a hefty $1.8 billion through convertible notes. That's serious money for a company making this kind of strategic pivot. I've watched several players in this space—IREN comes to mind—make similar transitions. The logic isn't complicated: these companies built massive infrastructure for Bitcoin mining but realized that serving the ravenous data needs of AI and cloud computing might offer more sustainable returns.

Think about it. Bitcoin mining operations are essentially specialized data centers with power infrastructure, cooling systems, and security already in place. The difference? Traditional data centers handle diverse workloads for multiple clients, while mining facilities run a single algorithm over and over, hoping to strike digital gold.

The strategic rationale makes sense on paper. Bitcoin mining is notoriously cyclical—tied to crypto prices and those pesky "halving" events that cut miner rewards in half every four years. Meanwhile, the AI computing boom has companies scrambling for both power allocation and physical space to put their servers.

(Having covered the data center industry since 2019, I've seen firsthand how tight capacity has become in key markets.)

Wall Street seems convinced. Analysts have been tripping over themselves to raise price targets on Wulf. But before you rush to call your broker, let's pump the brakes and ask some tough questions.

First—and this is crucial—how easily can Wulf's existing infrastructure actually transition to general-purpose data centers? It's not as simple as swapping out some mining rigs for standard servers. Power distribution, cooling requirements, and physical layouts for Bitcoin mining are highly specialized.

Second, what exactly is Wulf bringing to the table in an industry dominated by veterans? Companies like Equinix and Digital Realty have been at this for decades. Meanwhile, the cloud giants themselves are building facilities at a scale that would make your head spin.

And let's be honest about that stock jump. How much is legitimate revaluation versus speculative froth? When a stock climbs 77% in a month, momentum traders are definitely part of the story.

Google's stake does provide some validation... but Google makes strategic investments constantly. They need massive computing power for their AI initiatives, and having equity positions in potential suppliers gives them both insight and leverage.

That $1.8 billion capital raise? It's substantial firepower, though those convertible notes will eventually mean dilution for shareholders. The real question is whether Wulf can deploy this capital effectively in a market where relationships and expertise often matter more than just having deep pockets.

Look, the recent price consolidation after such a dramatic run-up is actually encouraging. It suggests investors are taking a breath, reassessing the company's prospects rather than continuing a vertical move that would inevitably end badly.

My take? Wulf represents an intriguing play on the intersection of crypto infrastructure and AI computing demand. But execution risks are substantial. This isn't just about flipping a switch from mining Bitcoin to hosting enterprise workloads—it's a fundamental business transformation that will test management's capabilities in entirely new ways.

If you're tempted to take a position, size it appropriately. This transition won't happen overnight, and Wulf needs to prove it can compete effectively against established players who've been at this game for years.

I'll be watching their next few quarterly reports with particular interest. The proof, as they say, will be in the pudding... or in this case, in the data center performance metrics.