The Financial Frontier, May 2024

When a reader tells me they've seen 100%+ growth two years running, my first instinct is to check if they're selling me something. My second is to look at what they're holding. And well, when I see tickers like RKLB (Rocket Lab) and ASTS (AST SpaceMobile) leading the charge, it all starts to make sense. You've caught lightning in a bottle during a very specific moment in market history – congratulations, sincerely. Now comes the hard part: figuring out what to do next.

The portfolio presented here tells a story of someone who's been willing to place significant bets on emerging technologies with high-risk, high-reward profiles. That's worked beautifully in a market environment that's rewarded speculative growth. But as our reader rightly suspects, trees don't grow to the sky, and 100% annual returns aren't sustainable over the long run. Not even for Renaissance Technologies in its prime.

Let's break down what we're looking at, and where things might go from here.

The Current Portfolio: Space, Energy, and a Dash of Nvidia

The existing portfolio has a distinct flavor profile – heavy on emerging tech with a particular focus on space and energy storage. RKLB (Rocket Lab) and ASTS (AST SpaceMobile) represent bets on the commercialization of space, while EOSE (Eos Energy) plays in the energy storage sector. NVDA (Nvidia) hardly needs introduction as the AI chip juggernaut. RTX (Raytheon) brings some defense exposure, while CRWV, GLXY, CRCL, and GEV round out with various levels of growth exposure.

What's immediately striking is the concentration of high-beta holdings that have clearly benefited from the 2023-2025 bull run in growth stocks. These companies have been perfect vessels for capturing market enthusiasm about space commercialization, alternative energy, and AI infrastructure. But what happens when – not if – market sentiment shifts?

The Potential Additions: Diversification Starts to Enter the Chat

The stocks our reader is considering show an instinct toward diversification that I find encouraging. GOOG (Alphabet) brings big tech stability with ongoing AI exposure. COST (Costco) offers consumer defensive qualities with a premium business model. LULU (Lululemon) represents high-end retail with pricing power. KRTOS adds more aerospace/defense exposure but in a different segment than Rocket Lab.

The inclusion of HOOD (Robinhood) and RDDT (Reddit) suggests our reader isn't entirely ready to abandon high-risk growth plays, which is fine – but these represent very different risk profiles than the current holdings.

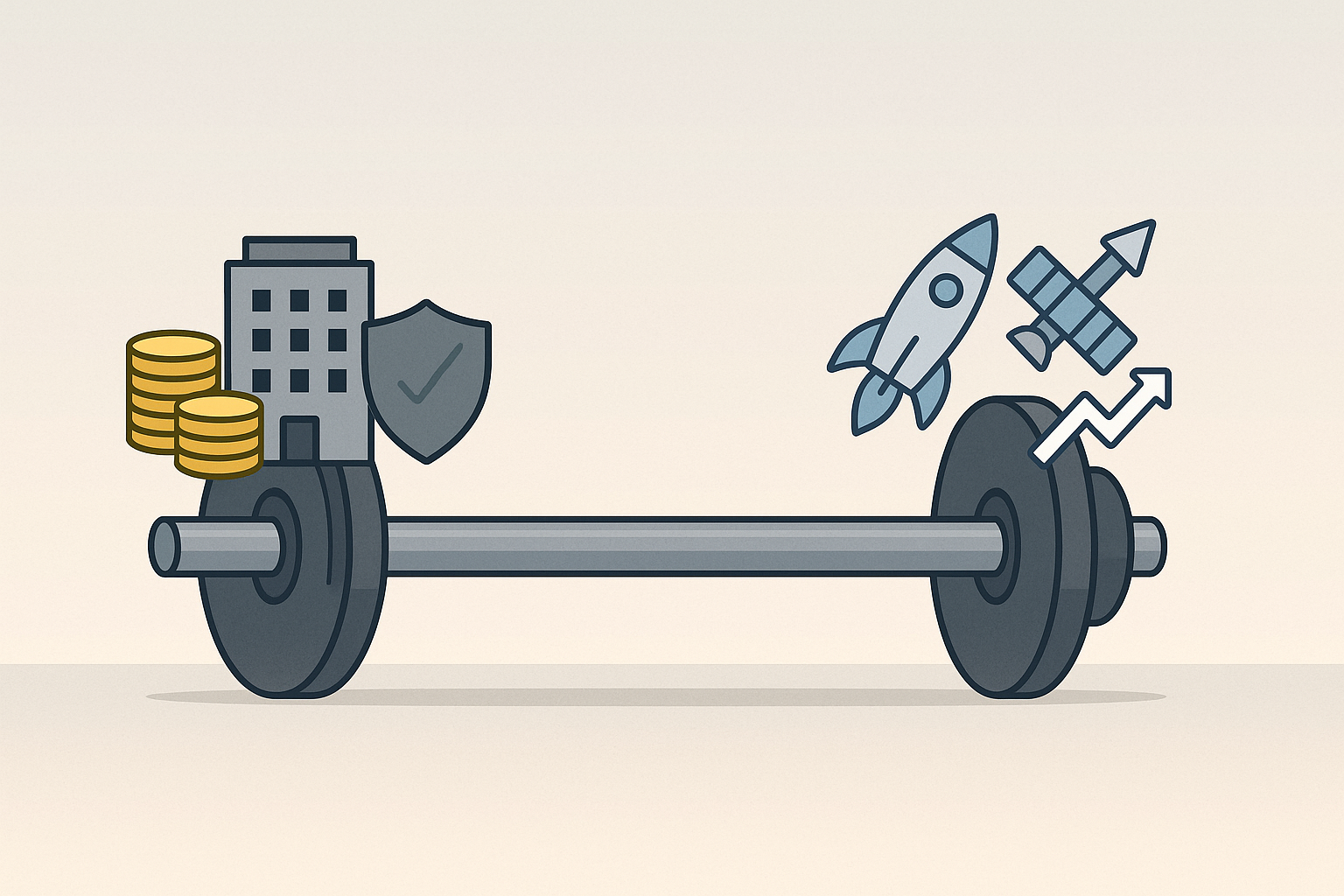

A Framework for 2026-2030: Barbell, Don't Barbel

For a portfolio meant to thrive through 2026-2030, I'd suggest thinking in terms of a barbell strategy – not to be confused with a "barbel strategy," which I assume involves investing exclusively in fitness equipment manufacturers.

A barbell approach would place some investments in stable, cash-flowing businesses with durable competitive advantages, while maintaining exposure to high-upside speculative plays. This provides both stability and growth potential, rather than concentrating entirely in the middle (moderate-growth, moderate-risk companies).

Here's how I might approach it:

The Stabilizers (40-50% of Portfolio)

- Keep NVDA (but perhaps trim if it's a massive position)

- Add GOOG (reasonable valuation with AI optionality)

- Add COST (consistent performer with subscription-based business model)

- Consider adding META or AMZN for additional tech exposure with proven business models

The Moderates (25-35% of Portfolio)

- Keep RTX

- Add LULU (strong brand moat, though watch valuation)

- Consider JBL for manufacturing exposure

- Consider NVT for industrial/electrical exposure with growth potential

The Moonshots (20-30% of Portfolio)

- Maintain positions in RKLB and ASTS (but perhaps trim if they've grown to oversized positions)

- Selectively add from HOOD, RDDT, OKLO based on your conviction

- Keep some dry powder for opportunities that don't yet exist

The Reallocation Dance: Timing Matters Less Than Method

The question of how to shift from your current allocation to a more balanced one matters. Rather than making dramatic moves all at once, consider:

- Setting target allocations for each position

- Using your weekly investments to build under-allocated positions

- Gradually trimming over-allocated positions during strength

- Using tax considerations to guide selling decisions

Thoughts on Specific Potential Additions

Google (GOOG): Among the most reasonable valuations in big tech, with plenty of AI potential and a fortress balance sheet. Strong addition.

Costco (COST): Never cheap, always quality. Their membership model creates stability few retailers can match.

Lululemon (LULU): Strong brand but watch for signs of saturation. Their expansion beyond yoga into general athleisure has been impressive.

Kratos (KTOS): Interesting defense play with unmanned systems focus. More speculative than RTX but potentially higher growth.

Robinhood (HOOD): Continues to seek profitability with expanding product offerings. Consider this part of your "moonshot" allocation.

Reddit (RDDT): The "front page of the internet" has demonstrated staying power, but monetization remains the question. Another moonshot.

The Psychology of Portfolio Management

Perhaps the biggest challenge won't be picking the right stocks but maintaining discipline during inevitable downturns. When you've experienced 100%+ growth, a "normal" 12% year can feel like failure. The psychological adjustment from spectacular to merely good returns is where many investors struggle.

Remember that beating the indexes over a 5-year horizon is still an ambitious goal – one that the vast majority of professional fund managers fail to achieve. Maintaining a balanced approach, adding regularly to your positions, and avoiding panic selling during downturns will likely contribute more to your long-term success than finding the next 10-bagger.

In other words, the secret to investment success from 2026-2030 might not be what you buy, but how you behave. And if you still manage to beat the indexes? Well, I've got some space on my calendar if you're offering portfolio advice.