By the time you realize you should've bought NVIDIA stock in 2015, it's already too late. That's how these things go.

Back then, NVIDIA was just "that graphics card company" — not the AI behemoth that would eventually crack the trillion-dollar market cap ceiling. Nobody saw it coming. Well, almost nobody.

I've spent the better part of a decade covering emerging technologies, and there's a pattern that repeats itself with almost cosmic regularity: transformative tech often hides in plain sight, masquerading as a niche interest until suddenly... it isn't.

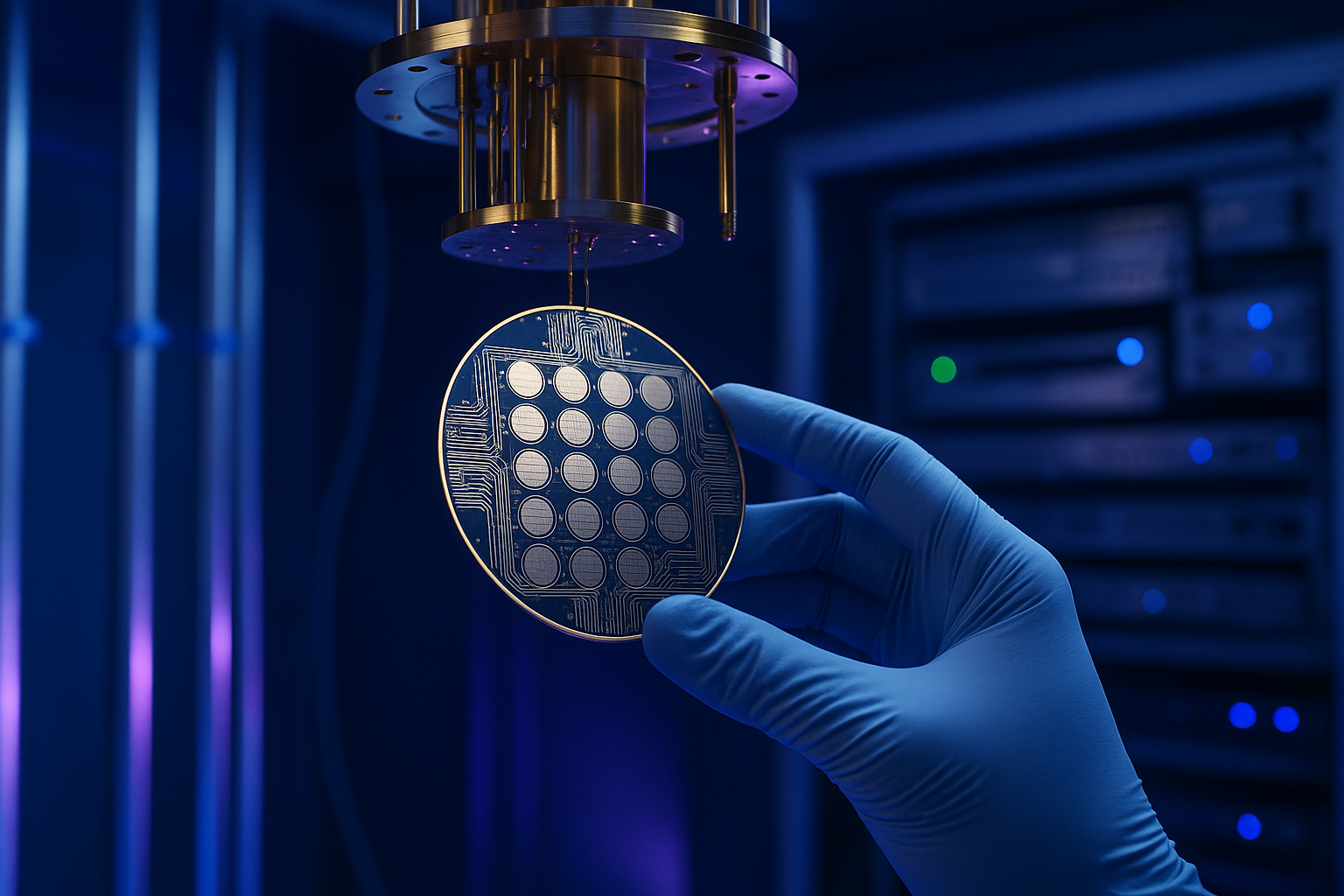

Which brings me to quantum computing. Could this be our collective blind spot? The next technological wave we'll all kick ourselves for not riding earlier?

The Quiet Quantum Race

"Everyone's fighting for AI dominance while quantum computing is quietly building the next battlefield," a venture capitalist told me at a recent tech conference, nursing what was probably his fourth espresso of the day.

He's not wrong. The quantum landscape is taking shape with surprising speed, though Wall Street still treats it like some far-off sci-fi fantasy rather than a rapidly emerging sector.

IBM has been methodically advancing its quantum roadmap for years. Google claimed that controversial "quantum supremacy" milestone back in 2019. Amazon offers quantum computing through its Braket service. Microsoft has Azure Quantum.

These aren't speculative bets — they're strategic investments by some of the world's most valuable companies.

But here's where it gets interesting.

The real potential 100-baggers aren't necessarily these tech giants. They might be the pure-play quantum companies flying under most investors' radars: IonQ and Rigetti (both public via SPACs, which, yes, doesn't exactly inspire confidence in today's market), plus privately-held contenders like D-Wave, PsiQuantum, and Xanadu.

Sound familiar? It should. Specialized technology companies developing hardware that could become critical infrastructure, while most investors yawn because commercialization seems too distant.

Just like NVIDIA circa 2015.

Looking for the "CUDA Moment"

Let's be clear about something. NVIDIA didn't become NVIDIA just because they made good graphics cards. Their position today stems from a perfect storm of preparation meeting opportunity.

When deep learning exploded, NVIDIA already had both the hardware (GPUs that were accidentally perfect for neural network training) and the software ecosystem (CUDA) that made them indispensable.

Quantum computing hasn't had its "CUDA moment" yet — that killer application that transforms the technology from "interesting" to "essential." But the candidates are lining up: pharmaceutical discovery, materials science, optimization problems that could save billions across industries.

I spoke with a quantum researcher from a major university last month who put it bluntly: "The first quantum computer to discover an important drug or design a room-temperature superconductor will change everything overnight. The only question is when, not if."

Winter Is Coming (And That's When You Should Buy)

Look, before quantum goes mainstream, we'll probably see a "quantum winter" — that inevitable period when hype collides with reality and early promises fail to materialize as quickly as the PowerPoint presentations suggested.

This happens with every transformative technology. AI has weathered multiple winters. Cloud computing was once dismissed as insecure and impractical for serious business use.

The smart money will be buying during this winter, while everyone else loses interest and moves on to the next shiny object.

Right now? We're still in the hype phase. Quantum companies are making bold claims. Investors are throwing money at anything with "quantum" in the name. The real test comes when these companies need to demonstrate actual commercial applications beyond glorified proof-of-concepts.

Many will fail. Consolidation is inevitable. The survivors will emerge stronger.

The Existential Threats

Could something derail the quantum dream entirely? Sure.

Three threats loom largest:

Error correction problems that prove fundamentally unsolvable at scale. Quantum states are notoriously fragile, and maintaining coherence while scaling up is devilishly difficult.

Alternative technologies that deliver "good enough" solutions. Advanced classical algorithms or specialized computing architectures might provide sufficient gains to make quantum's advantages less compelling for many applications.

Economics. If quantum systems remain extraordinarily expensive and difficult to use, adoption could stall indefinitely.

But... haven't we heard all this before? Semiconductors faced "insurmountable" challenges with each new node. The internet was going to collapse under its own weight. Mobile phones would never replace landlines.

(Spoiler alert: Technology has a funny way of solving seemingly impossible problems when there's enough money on the line.)

The 20-Year Game

Having covered tech long enough to see multiple cycles play out, I can tell you this: The quantum computing revolution won't happen overnight. Even NVIDIA took years to transform from a gaming company to the AI juggernaut we know today.

The companies dominating quantum in 20 years might not even be the current leaders. They might not even exist yet.

The safest bets are probably the tech giants already investing heavily in quantum — IBM, Google, Microsoft, Amazon. They have the resources to weather setbacks and complementary technologies to build complete solutions.

But the biggest returns? They'll come from identifying those pure-play quantum companies that survive the inevitable shakeout and emerge as the infrastructure providers for the quantum age.

Twenty years from now, we'll all be looking back, saying "If only I'd bought [insert quantum company name] back in the 2020s when everyone thought it was just a science project..."

The question is: Which company will that be? And are you paying attention yet?