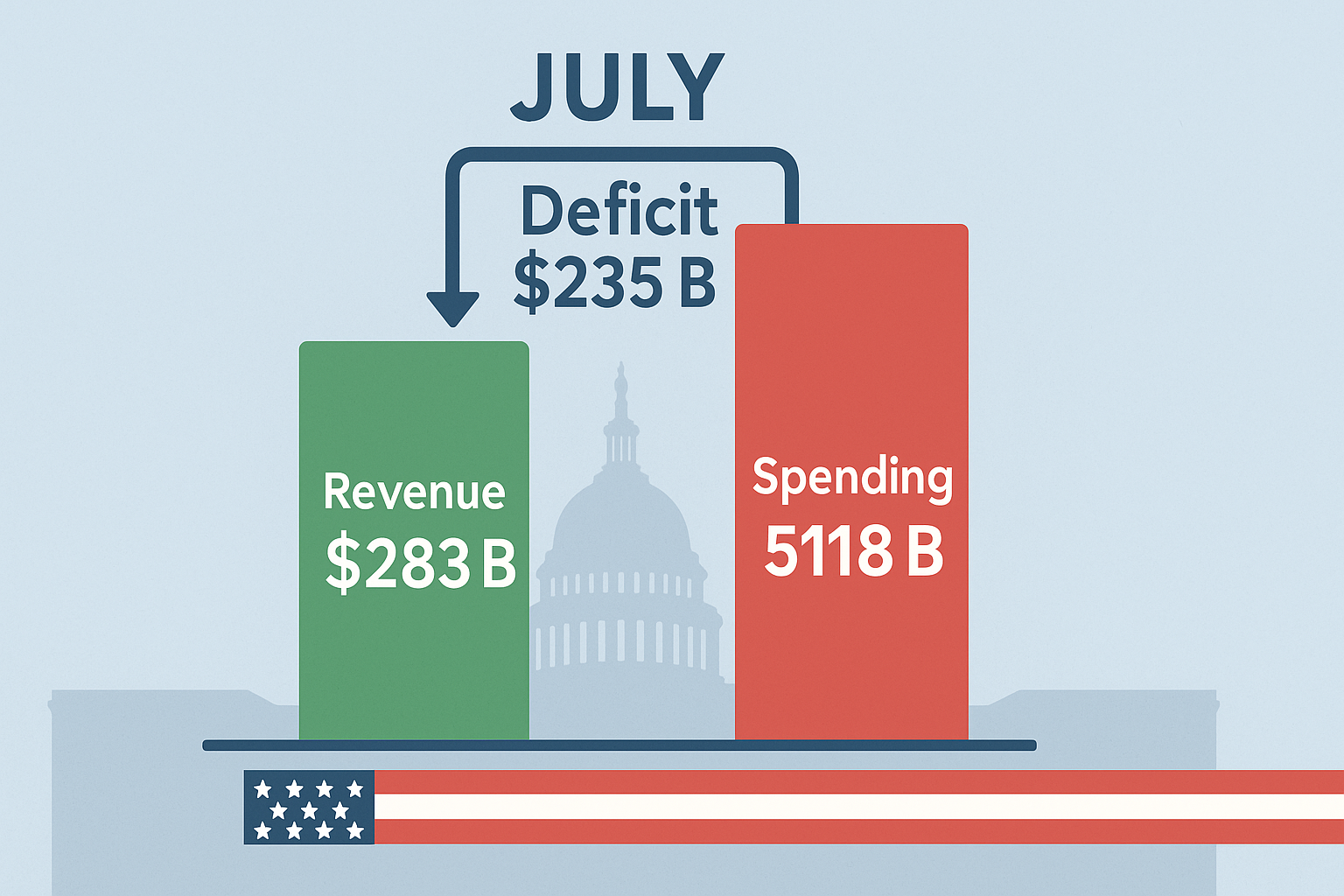

The latest federal budget numbers landed yesterday with all the subtlety of a piano dropping from a fifth-floor window. July's deficit? A cool $235 billion—up a staggering 20% from the same month last year.

It's the fiscal equivalent of getting a fat raise at work while somehow ending up with an even emptier bank account than before.

Here's the head-scratcher: federal revenue actually climbed to $283 billion. Those Trump-era tariffs that had everybody hollering a few years back? They're now pumping serious cash into government coffers. The administration hasn't been shy about pointing this out, either. "See?" they seem to be saying. "Economic nationalism pays dividends!"

Except... it doesn't. Not really. Not when you're spending money like a lottery winner on day one.

Federal spending exploded to $518 billion for July alone—a 13% jump year-over-year. Look, I'm no mathematician, but when your spending grows faster than your income, you end up deeper in the hole. That's not complex economic theory; that's what my grandfather taught me when I was twelve.

I've covered government budgets since the Obama years, and there's something almost otherworldly about how Washington approaches fiscal matters. In any normal business, a 20% increase in losses would have shareholders storming the boardroom with pitchforks and torches. In D.C.? It barely registers as Tuesday.

What kills me is the messaging strategy. The administration trumpets tariff revenue like they've discovered financial alchemy while conveniently mumbling about the overall deficit numbers. (It reminds me of my brother-in-law who brags about saving $50 with coupons while ignoring the $500 he spent on stuff he didn't need.)

The big picture doesn't offer much comfort, either. Ten months into this fiscal year, we're staring at a $1.61 trillion deficit—up 10% from last year. And that's happening during what economists keep telling us is a strong economy with historic low unemployment! Shouldn't government coffers be overflowing during the good times?

Most disturbing? The markets barely blinked. Bond traders have apparently accepted America's fiscal incontinence as the new normal. I remember when a $200 billion annual deficit caused joint congressional committees and stern presidential addresses. Now we rack up that much in a month, and it's just another day ending in "y."

The Congressional Budget Office—those cheerful folks who crunch these numbers—projects deficits averaging about $2 trillion annually for the next decade. That translates to roughly $6,000 of fresh debt per year for every American man, woman, and child.

By 2053, our debt-to-GDP ratio is expected to hit 180%. For perspective, that's "Greece during its financial meltdown" territory.

Meanwhile, the interest payments on our existing debt reached $81 billion in July alone—nearly 30% of the entire month's federal revenue. We're approaching the point where we'll need to borrow money just to pay the interest on the money we've already borrowed. My credit card company would've cut me off long before I reached that point.

So there we have it. Record tariffs, solid employment numbers, decent economic growth... and we're still digging the hole deeper.

In Washington, I guess that's what passes for success these days.